Dune-bashing in Dubai. Hiking to Machu Picchu in Peru. Marveling at the Taj Mahal in India. Going on a safari in South Africa.

While it sounds like an excerpt from a brochure, these are just a handful of the experiences I’ve been able to check off my personal bucket list for travel.

Hi, my name is Oneika and in a typical year, I eat, sleep, and breathe travel. There’s something about being somewhere new, seeing something different, and learning about different customs, cultures, and traditions that just… gets me.

But if you’ve followed me for any amount of time, you’ll also know that I’ve shifted my focus to bucket list trips and experiences. I mean, in my mind, if I’m getting on a plane, train, or automobile I might as well go big before I go home, amirite?!

Practically, this means that I didn’t just visit Victoria Falls, I low-key swam in it (and bungee jumped off the Victoria Falls Bridge, but that’s a story for another day). I’ve also slept in a yurt in the Mongolian steppe, ziplined through Costa Rican rainforest, and done high tea too many times to count in London.

However, while these bucket list adventures are epic, thrilling, and fulfilling, the harsh reality is this: they can be quite expensive.

One of the number one reasons people don’t travel is because they think they can’t afford it. But as someone who has dedicated my platform to making exploration and discovery more accessible, I’ve realized that there are a few easy things you can do to come closer to making your travel dreams a reality.

That’s why I’m excited to partner with You Need A Budget to share three major tips and tricks for how to budget for your trips, whether they are big or small!

___

Making travel a priority

One of the questions I’m asked the most frequently by friends, family, and strangers is how I can afford to travel so much. Here’s my big “secret”: while I’m not rich, I tend to allocate the money I do have to trips and experiences. This means that instead of spending money on the latest smartphone or a designer purse, I save it for bucket list adventures abroad… like going to Egypt to see the pyramids of Giza.

I’m also able to save more money because of certain lifestyle choices I’ve made, like not having a car (gas and insurance are expensive). Because my passion for discovery is of the utmost importance, I’m willing to make little “sacrifices” like not getting cable (I mostly stream on Netflix anyway) or skipping appetizers and dessert when I go out to eat so that I have more money to put towards my dream trips. This is a simple, yet effective strategy!

Careful planning

I can’t stress the importance of meticulous planning when it comes to booking my bucket list travels! Whenever possible, I try to travel to a destination during its off-peak season so I can not only avoid the crowds but also take advantage of discounted air fares, attractions, and accommodations. Speaking of accommodations, I often compare the cost of staying in an Airbnb/ vacation rental vs. a hotel room and go with the cheaper option. Depending on my destination and how much time and money I have to burn, staying in one instead of the other might just make more sense (and help me save more dollars and cents, haha).

Another strategy that has allowed me to travel more frequently and at a cheaper rate has been to chase the deal and not the destination. I tend to plan my travels these days based on the cheapest airfares and travel discounts at a given time, and not just based on where I want to go/what I want to experience.

Making a proper budget and sticking to it

While prioritizing and planning play a fundamental role in my ability to tick items off my travel bucket list, the third, and in my opinion most important, element in this equation is budgeting.

I’ll be honest, I’ve always been pretty good with managing my money on my own. But since I started using You Need a Budget to consciously plan for the future, I have a more accurate picture of my finances and better control over when, how, and why I spend my money.

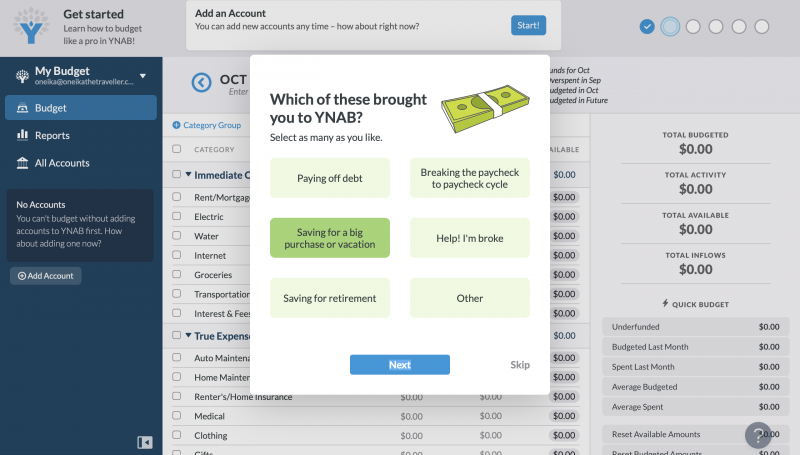

But just what is this magical You Need a Budget, you ask? Well, You Need a Budget (YNAB for short) is an award-winning personal finance software that will teach you how to get out of debt, stop living paycheck-to-paycheck, and save more money so that you can spend it on the things that matter most to you (traveling, in my case).

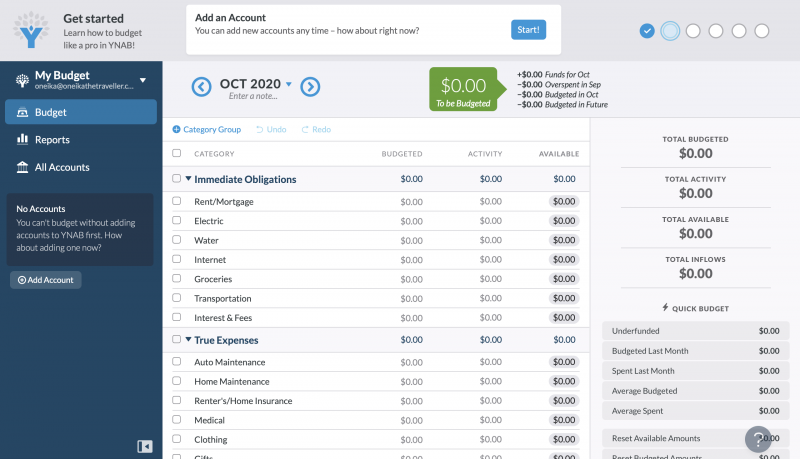

Personally, You Need a Budget has helped me to create a spending plan so I can prioritize and plan for future travel or major life events. Signing up is extremely easy! Because the interface is so straightforward and clear, within 10 minutes I was able to input all my account details and expenses in order to start a savings plan.

Not too sure you’re ready to commit? YNAB not only has a free 34-day trial that doesn’t require you to give your credit card details, it also offers educational content, vidoes, and live workshops every single day that are completely FREE.

You can try YNAB for 34-days free (no credit card required) if you click here!

The thing I like most about YNAB is that it takes the stress and mystery out of budgeting. YNAB’s Four Rules set you up for success by treating the budget as a daily lifestyle tool, rather than some crazy aspirational plan that you can’t maintain. Their Four Rules are:

○ Give Every Dollar a Job. Know exactly how you want to spend the money you have available – and only the money you have right now – before you spend a dime. This helps ensure that you have money for the things that matter most to you!

○ Embrace Your True Expenses. Figure out what you really spend and treat those infrequent expenses (like the holidays, twice-a-year car insurance or replacing your laptop every two years) like monthly expenses in your monthly budget. Breaking big or uncommon expenses down means you won’t be surprised by them.

○ Roll With the Punches. Accept that things change and your budget needs to be flexible (especially in a year like this one, whew!) You won’t spend the same amount on all categories every month, so be prepared to move money around. Moving money around doesn’t mean you are budgeting wrong, it means you are actually budgeting!

○ Age Your Money. Break the paycheck-to-paycheck cycle by working towards using the money you earned last month to pay this month’s expenses. This margin will create more peace of mind than you can even imagine.

Source: YNAB

Making a proper budget doesn’t have to be a big deal or a scary prospect when you have the right tools. Using YNAB has allowed me to take complete control of my finances so I can have enough money to spend on the things I truly value, like bucket list travel! This is a big step on the road to financial freedom.

___

So there you have it, my three tips for how I afford to travel so extensively and budget for my bucket list adventures! In essence it boils down to this: serious prioritizing, diligent planning, and EXCELLENT budgeting. What tips do you have for how you afford to travel? Drop ‘em in the comments below!

This post was written in partnership with You Need a Budget but all opinions are my own.

Please visit:

Our Sponsor