In recent years, “pay-over-time” installment plans have become increasingly popular in the Canadian credit card market. These products allow customers who make large purchases to set up payment plans with fixed monthly fees, rather than carrying a balance and being subject to their credit card’s regular interest rate.

While we always recommend paying your credit card balance in full each month to avoid interest charges, sometimes unexpected expenses leave you with a balance at month’s end.

In this article, let’s take a closer look at American Express Canada’s pay-over-time offering – known as Plan It – to understand how it works and whether or not it’s actually a good deal compared to carrying a balance on your credit card.

What Is American Express Plan It?

One of the most common concerns that consumers have about credit cards is high interest rates. With annual percentage rates (APRs) hovering around 20.99% for most Canadian credit cards, interest charges can quickly add up for those who spend more than they can immediately afford to repay.

This is where “pay-over-time” plans come in. These installment plans are designed to simplify payments for large purchases with fixed fees, instead of making consumers deal with the often confusing calculations of credit card interest.

Many Canadian banks now offer consumers “pay-over-time” products, including CIBC Pace It, Scotiabank SelectPay, and American Express Plan It, amongst others.

These products charge either a set monthly installment fee, a reduced APR, or some combination of the two for customers who want to split payments for large purchases over time, rather than carrying a balance forward each month.

Amex Plan It stands out for its simplicity – it uses fixed monthly installment fees instead of more complicated APR calculations.

Currently, Plan It is available on the following American Express personal and small business cards:

It’s worth noting that Plan It isn’t available to cardholders in Quebec, Nova Scotia, Nunavut, or Prince Edward Island.

How Does American Express Plan It Work?

To use Amex Plan It, you can either make a qualifying purchase of at least $100 and then create a plan, or choose to pay down a portion of your most recent monthly statement balance using Plan It.

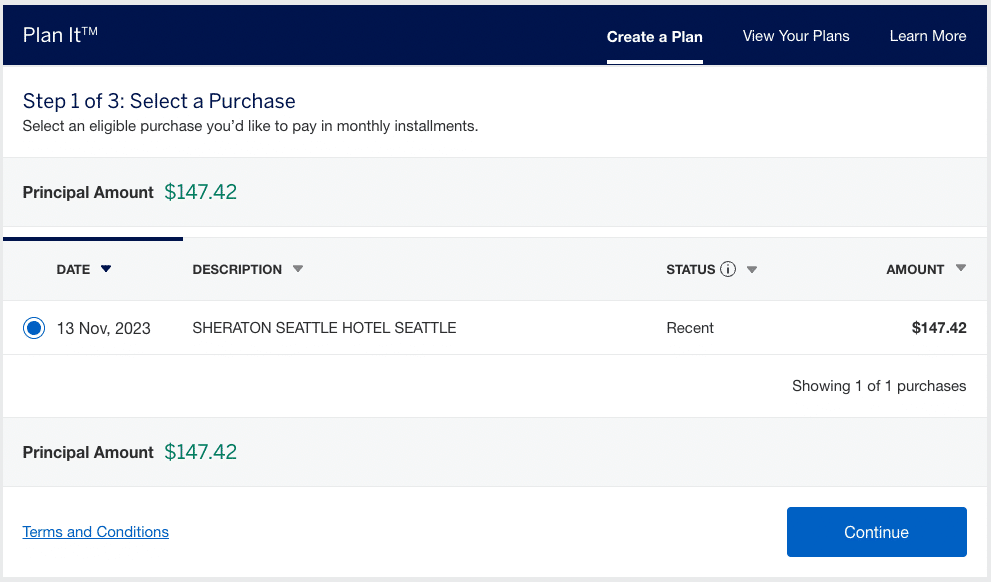

Setting up a Plan It installment plan is a simple three-step process.

First, on your Plan It landing page (accessible through your American Express account), you’ll see a list of eligible purchases for which you can create a plan. On this screen, you can select one or more purchases, and the total of the principal amounts will be displayed.

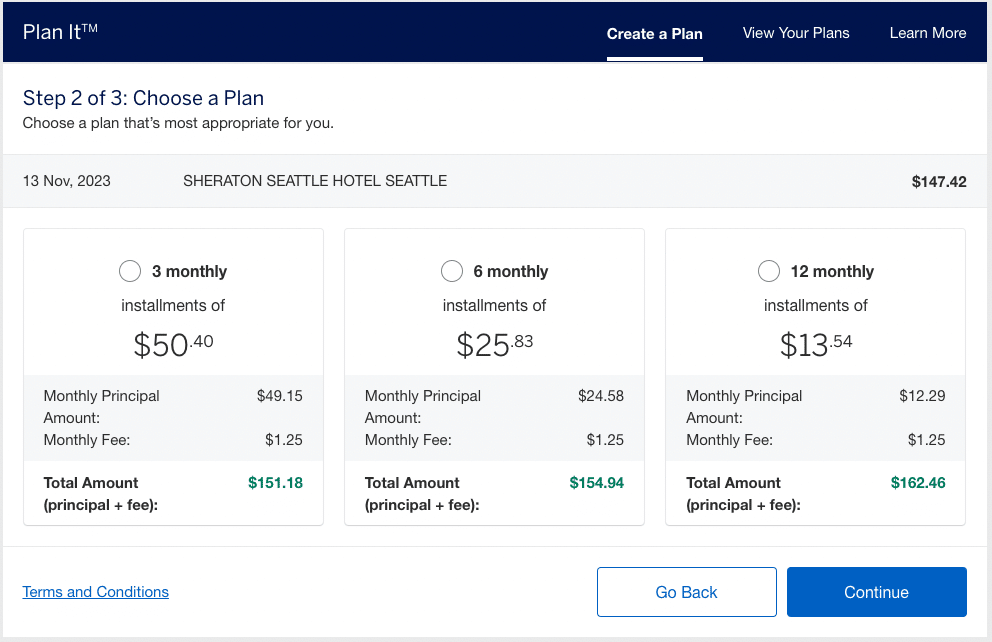

Next, you’ll see three options for Plan It installment plans. For each, you’ll see the monthly principal payment amount, the monthly fee, and the total monthly payment (principal + fee).

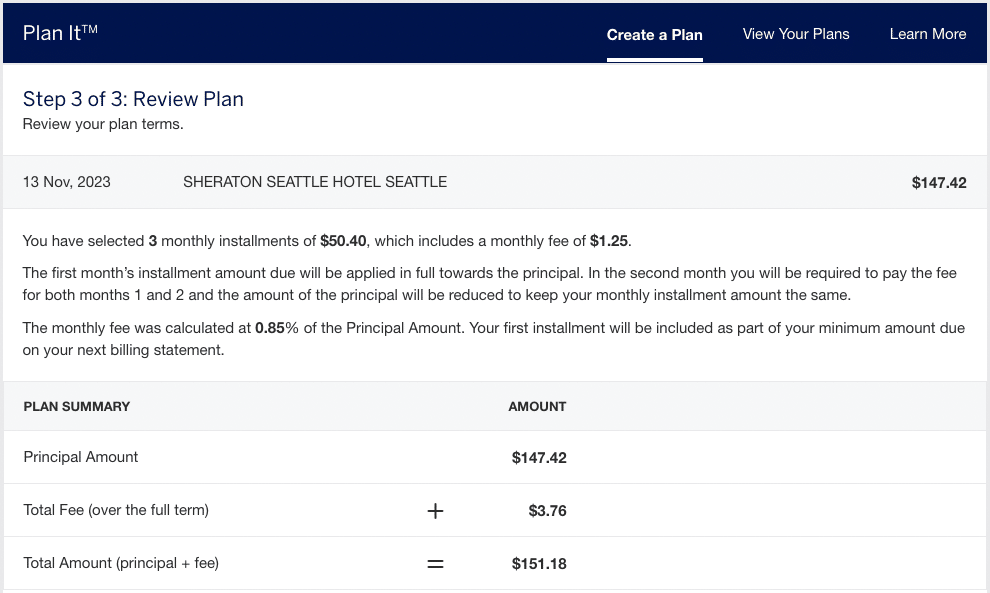

After selecting one of these options, you’ll be taken to a summary page that details what you’re signing yourself up for. The terms of your installment plan, including the monthly fee calculation and the total amount you’ll pay over the course of the plan, are displayed alongside the program’s terms and conditions.

If everything looks good, click “Submit,” and your Plan It installment plan will be set up shortly.

Once your plan is established, the total amount will be deducted from your available credit, the charge(s) included in your Plan It installment plans won’t accrue interest, and your monthly minimum payments will include the agreed-upon amount (principal + monthly fee).

You must make the minimum payment each month, or your installment plan will be cancelled and the charges will accrue interest as usual. If you have pre-authorized payments set up, the minimum payment (including the Plan It principal + monthly fee) will be automatically deducted from your account.

Is American Express Plan It a Good Deal?

Before we dive into whether Plan It is worthwhile, let’s reiterate that the best financial strategy is to pay off your credit card balance in full each month. This way, you avoid interest charges that effectively reduce the value of any points or rewards you earn from your card.

However, if you find yourself with unexpected expenses that you can’t pay off immediately, it’s time to look any options that may reduce the amount you pay in interest.

If you’re thinking about using Plan It, understand that it comes with a cost, which is clearly shown during setup. The rate you’re charged will vary, so it’s important to check the monthly fee calculation rate each time to see how it compares to your card’s annual interest rate.

The monthly fee can be as low as 0% during promotional periods, but typically ranges from 0.35–0.9% of the principal amount.

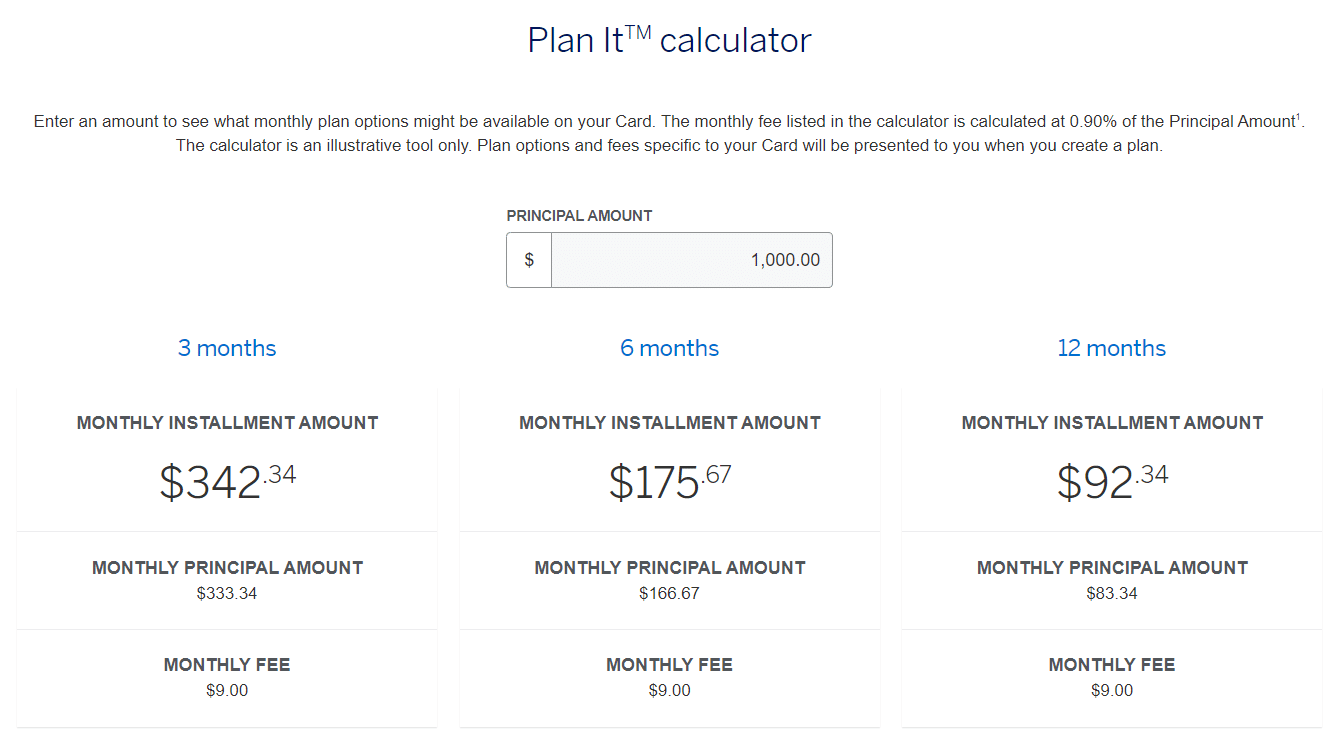

For example, let’s look at a $1,000 (CAD) purchase with a monthly fee calculated at 0.9% of the principal.

You might be presented with three options, each with a monthly fee of $9 plus the principal amount, divided into three, six, or twelve equal payments.

Depending on which plan you choose, you’d pay different total fees compared to paying off the purchase immediately:

- Three months: $27 in fees

- Six months: $54 in fees

- Twelve months: $108 in fees

If instead of using Plan It, you carried a $1,000 balance on your credit card with an APR of 20.99% and paid it off in the same time frames, you’d pay the following:

- Three months: $35.19 in interest

- Six months: $62.11 in interest

- Twelve months: $117.31 in interest

As you can see, you’d save a small amount by using Plan It versus carrying a balance and paying it off over the same period in this example. This also assumes you’re not making any other purchases on the card during this time.

If you receive an offer with a lower monthly installment fee, the effective APR for your Plan It offer decreases, potentially saving you more money compared to carrying a balance.

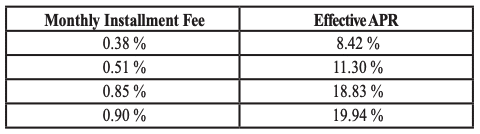

In the terms and conditions of eligible American Express cards, you’ll find a table showing the effective APR rates for different monthly installment fee percentages.

As you can see, a monthly installment fee of 0.90% equals an effective APR of 19.94%, while a fee of 0.38% equals an effective APR of just 8.42%.

So if you have a lower monthly installment fee offer through Plan It (which can be as low as 0% during promotions), you could save significantly compared to carrying a balance on your credit card and paying it off over the same period.

If you see Plan It as an option on your account, carefully review the offer details to determine if it’s a good deal for your situation.

If the effective APR is higher than what you might get with a balance transfer offer, a low-interest credit card, or a line of credit, you’re better off exploring those alternatives to minimize your interest costs.

If you’re unsure which option is best for your situation, consider consulting a financial professional for personalized advice.

Conclusion

Amex Plan It offers eligible cardholders the ability to pay off purchases over time for a fixed monthly fee instead of dealing with regular credit card interest rates.

The product is quite straightforward to use if you have an eligible American Express Canada credit card and make a qualifying purchase.

However, before jumping in, compare the fees against your card’s APR and any other credit options you might have access to. You could potentially save money through balance transfers, low-interest cards, or lines of credit.

Please visit:

Our Sponsor